We don’t very often talk about when is the right time to stop having life insurance. We’re usually more interested in making sure you've got it when you need it. But there does come a point when you don’t need it as much as you once did. The hard part is working out when that is.

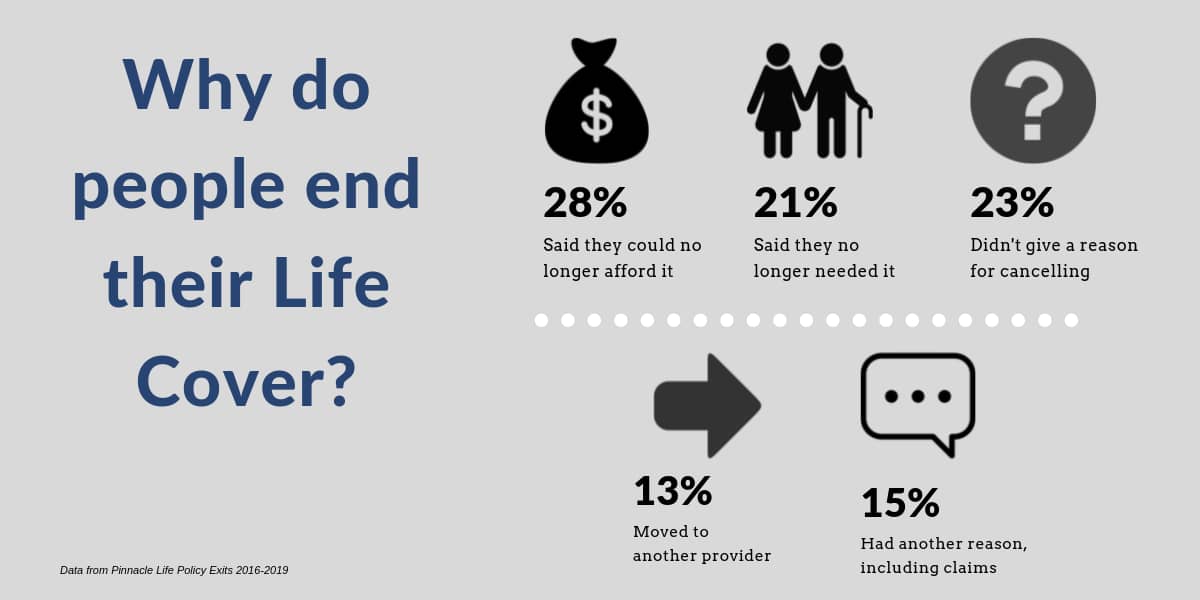

Statistics from our customers show the main reason people ended their Pinnacle Life cover was affordability. This is tricky because there are multiple reasons a policy may become unaffordable. Your circumstances may change, reducing the budget you have available for insurance, for example a drop in income or an increase in household expenses such as rent. Or, because Life Insurance premiums increase as you get older, the annual increase may have pushed the premium beyond your affordability level. When we speak with customers in these situations, we try to work out a solution that will allow them to continue to keep their Life Cover and protect the people they love, but within their means.

The second reason people ended their Pinnacle Life cover, and gave a reason for it, was because they no longer needed it. When you have people who depend on you financially and who would struggle if something were to happen to you, you need it. Once your kids have left home and you’ve paid off your mortgage you possibly don’t. Even if you still have some mortgage left you may decide that the money you’re spending on premiums would be better off quickly clearing the last of your loan. This decision depends on your personal financial situation, what you’re earning, your assets, other debt etc.

It can be tempting to change Life Insurance providers to get a better price. (For example if you switch to Pinnacle Life we will give you 20% off your current premium for the life of your policy). Our statistics show that in the last 4 years, around 13% of those who cancelled their Pinnacle Life policy moved to another provider. But it pays to be a bit cautious before you switch. If you’ve developed health conditions, your new policy may not cover those. You should also check that the new policy has the same or similar benefits to your old policy so that you know what you’re covered for.

15% of the policies that ended, did so for a wide variety for reasons. This included; policies that had a death claim so were paid out; expired policies where the policy had a maximum age; as well as policies that ended when the owner got cover through an employer; or they moved overseas. There are numerous reasons people choose to end their cover.

The point is, like all insurance there is a time when you really need Life Insurance and a time when you don’t. The reasons people end their policy depends on their personal situation. If you aren’t sure if you still really need it or are struggling with affording your cover, get in touch we’d love to help.