Getting married should be one of the best days of your life. It can also be the most stressful and can easily become overwhelming. The peak time for weddings in NZ is October through March and around 40% of all weddings occurring in the first 3 months of the year. With Christmas around the corner, that means wedding season is only just getting warmed up.

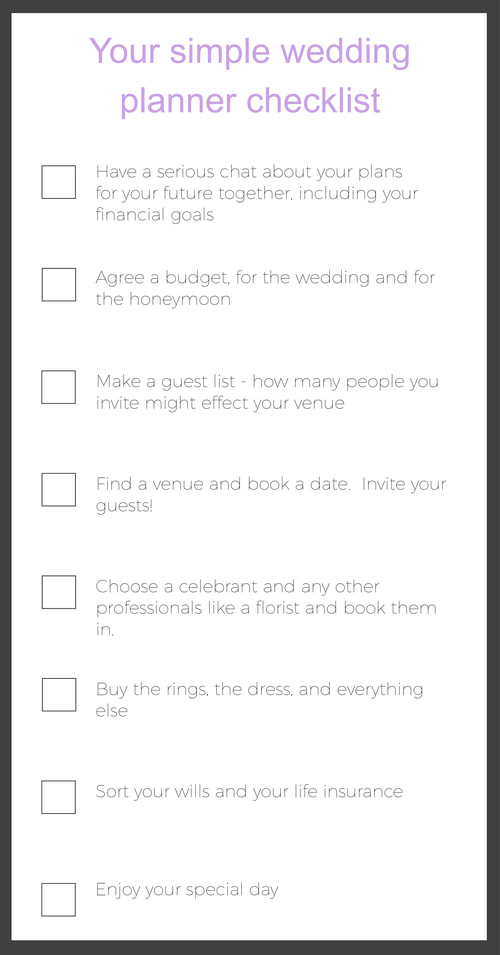

A wedding planner can help you make many of the decisions about the ins and outs of the ceremony and reception. There are also lots of websites that have helpful tips. But there are a few things that your planning checklist might be missing that go beyond ordering your flowers and working out your place settings. In the lead up to your big day, you should also make time for a serious conversation, to make sure that you're both on the same page when it comes to your finances and the type of life you want to live together. Making sure you both have the same attitude towards money is central to establishing trust about your finances and will help to ensure a strong financial future in your married life together.

Your wedding may be the biggest financial commitment you have made yet as a couple. Being on the same page as to what you can afford and how you're going to pay for it may set the tone for how you manage your finances in the future.

Weddings can be expensive. The average cost of a wedding in New Zealand is around $35,000. Of course, they can be significantly cheaper or more expensive than this. Having a plan is key. If you're starting to think about your post-wedding finances, it may help to speak to a financial planner. A financial planner will help you work out your financial goals and how you can achieve them.

A wedding is just the start of you and your partners lives together. So, at some point, earlier rather than later, you should think about protecting your future. It may seem a bit grim to be thinking about sickness or death whilst planning your wedding but being realistic and setting yourselves up for the future is the best start you can give to your married relationship. A life insurance policy from Pinnacle Life will pay a tax-free, lump-sum to the owner of your policy if you die or earlier if you're diagnosed with a terminal illness. It can help those you leave behind to pay the rent or mortgage, put food on the table and pay the bills or it can be used to invest in your children's education or other things you want for your family. It's never too early, or too late, to be thinking about life cover. At Pinnacle Life you can get a quote online in under 30 seconds and be covered in 10 minutes, easy.