Our business is all about paying out claims when the unexpected happens to you or your family. Our aim is to get the payment made for you as soon as possible.

This means that we usually pay a claim within 7-10 business of getting all the information we need.

To get all of that information to us can take some organising, so to help your family or your executor get things sorted quickly here’s a few tips to smooth the way.

When setting up your policy

- Make sure that you use your correct legal name, not a nickname, when you apply for your policy. It slows the process down if the death certificate is issued in your legal name, but you gave us your nickname or commonly used name when you took out the policy. If you regularly use two names then let us know when you take out your policy and we can get all the details sorted out up front.

- If you want the money paid to a particular person, rather than to your estate, make sure you fill in the change of ownership form that is attached to your policy document and send it back to us. This will mean that your claim will be paid directly to that person, not to your estate.

- Give a copy of your policy to the person who either owns the policy, or the person who will look after your affairs if anything unexpected happens. That way, they know to contact us. You’d be surprised at how many calls we get from people who are ringing around insurance companies to see if a family member had a policy anywhere.

- We might need to gather medical information as part of the process, so we ask for your GP’s details upfront and record it on your policy document. If you change GPs make sure you’ve got a record of that so your family can help us find the details we need.

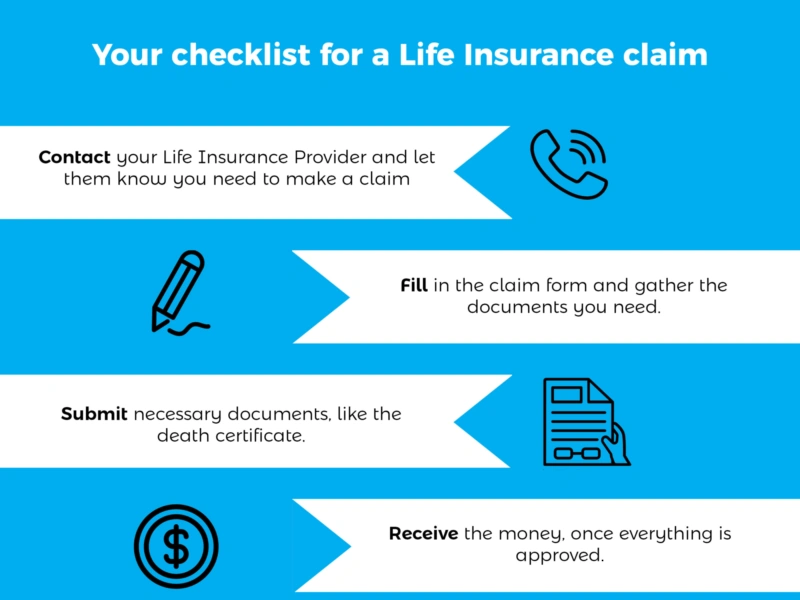

When claiming on your policy

The best thing to do is call us so we can help you through the claim process. We also have information available on pinnaclelife.co.nz to help you understand how the process works.

We’ll always need:

- proof of identity, like a birth certificate or passport, and

- a form signed by the person receiving the payout.

Some other common requirements are:

| For a ... | We'll need ... |

| death claim |

a copy of the insured person’s death certificate, and a coroner’s report if one has been issued. |

|

illness or disability claim (like a terminal illness, critical or serious illness claim) |

a written opinion from a medical specialist confirming that the insured person meets the criteria outlined in the policy document. We may then need further information, including information from the insured person’s doctor. |

| accidental death claim | a copy of the insured person’s death certificate, and a copy of the coroner’s report |

And if we need further details we may go back to your doctor as needed.

Hopefully all this information is easily available, although if accidents happen overseas etc, it can sometimes take a bit more time to get all the information required.

Other things you might want to think about

Of course, once we pay out on a life insurance policy, it doesn’t mean the money is always instantly available to the family.

If someone dies, and they are also the owner of the policy, then the money will be paid out to the life insured’s estate. This is where having a will and clear instructions for what is to happen with the money and your other assets is important. Not having a will can cause delays, as someone like a lawyer, or the Public Trust needs to try and work out who is entitled to share in your estate.

Did you know that you don’t necessarily have to die to access your life insurance benefits, your life cover policy probably has a terminal illness benefit on it – this means you can access your life insurance if your doctor confirms that you don’t have long to live. Contact our team to find out more about this.

So hopefully these few tips will help you plan ahead, so that if you ever need to claim, that it is as straightforward as possible.