Knowledge, Trust & Advice –The 3 Ingredients to the Perfect Policy

The Financial Markets Authority recently released the results of their inaugural Customer Experience survey. The research intended to provide a snapshot of the financial services sector, how consumers interact within it, and how they perceive their banking, investing, and insurance providers. In this blog, we focus on:

·The consumer’s mindset and knowledge of financial matters

·Consumer’s trust in financial institutions

·Where consumers seek financial advice and information

·Insurance product and service ownership

Mindset & Knowledge

It appears that many people are confused about financial matters. Only half of New Zealanders feel they have a good level of financial understanding, indicating that the gap in financial confidence and literacy is real. This is no surprise, as when it comes to financial jargon, it can get complicated quite quickly. That is why we try to describe things in plain English, especially with our Online Advice tool. The FMA found that confidence was at its lowest for Māori and Pacific people, females, 18–24-year-olds, and those with annual household incomes under $20,000.

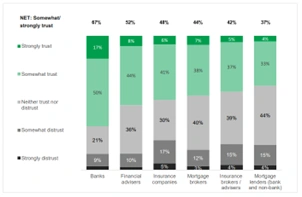

Trust in Financial Institutions

Less than half of New Zealanders trust insurance companies (48%), with even less trusting insurance brokers or advisers (42%). Insurance companies are the most distrusted, as 22% say they somewhat or strongly distrust them. When it comes to demographic differences;

·Females are more likely to trust banks and insurance companies than males.

·Younger people between the ages of 18-34 are more likely to place their trust in advisers under 55, and

·People with higher incomes have a higher level of trust in all institutions except insurance companies.

·Māori are less likely to trust banks than people of other ethnicities.

Advice Seeking & Product Ownership

When seeking information or advice, people use an average of three sources. The majority turn online (52%), a large proportion of 18-24-year-olds look to social media and 27% turn to recommendations from friends and family. But what we found most interesting was that 40% are more likely to trust automated digital tools to find insurance products.

There are several significant differences in insurance product ownership across demographic groups.

·18-34-year-olds are less likely to have any insurance types except health and pet insurance.

·Ownership of life and health insurance picks up in the 35-54 age group and

·Then declines again among those aged 55 or over.

·Insurance ownership significantly increases with annual household incomes above $100K.

The three most important ingredients to finding the best policy are; understanding insurance, finding a provider you trust, and getting advice. The answer is simple. What is it? Digital Advice, our automated online advice tool. When it comes to understanding insurance, we like to provide our tailored advice in plain English, so it’s easy to understand without the curveballs.

You can also put your trust in Digital Advice. Earlier this year, we gained our FAP (Financial Advice Provider) license. What does this mean? It means that our customers will receive the best possible outcomes from our advice, including from our online tool. When seeking advice and information - our tool can provide three cover options in just 10 minutes, in the comfort of your own home.

If you want to learn more about Digital Advice, why don’t you see what cover best suits you!