Life insurance comparison

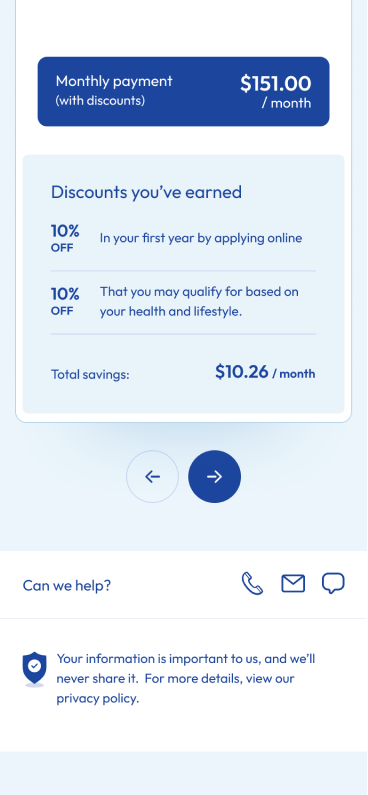

Comparison of prices for a 42-year-old non-smoking male with $350,000 of life insurance cover.

-

Pinnacle Life$31.15/ month

-

Chubb$36.21/ month

-

AIA$42.45/ month

-

Westpac$40.05/ month

-

Partners Life$41.14/ month

-

AA$43.25/ month

Pinnacle Life's price includes a 10% discount for the first year, and 10% healthy lifestyle discount which you may or may not be eligible for.

Award winning service

Learn more

Price Comparison Top Choice

Comparing life insurance quotes in New Zealand can feel tough. We make it easy by regularly evaluating quotes from different Kiwi life insurers, ensuring Pinnacle Life remains your top choice for affordable individual and joint life policies. Policies start at just $0.55 per day, with cover online from $50,000 to $1,500,000. Get your quote in 30 seconds and covered in 10 minutes.

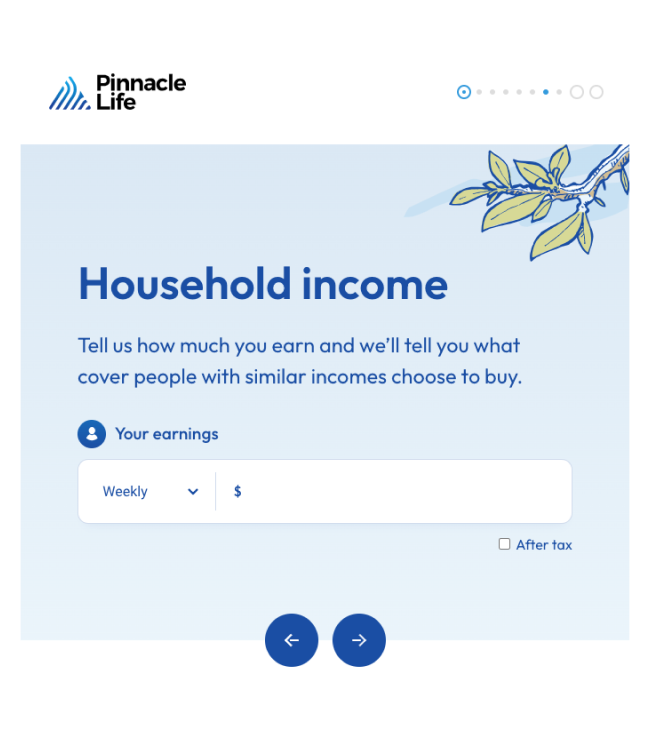

How much life insurance do other people have?

When you're trying to figure out how much life insurance you need, seeing what other people have can be helpful.

Let us know your gender and age, and we will show you what life insurance other people like you have looked at. This is a great starting point for what might be right for you. We've accessed over 158,000 quotes over two years, so you'll get a good ballpark.

When you're trying to figure out how much life insurance you need, seeing what other people have can be helpful.

Let us know your gender and age, and we will show you what life insurance other people like you have looked at. This is a great starting point for what might be right for you. We've accessed over 158,000 quotes over two years, so you'll get a good ballpark.

We keep things simple. Our policies are written in plain English.

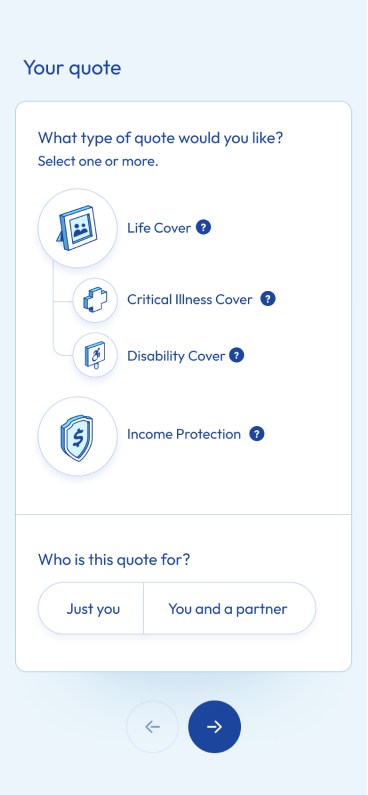

Life Insurance

Life insurance provides for those you leave behind. It helps them pay the mortgage, invest in education, put food on the table, and pay the bills.

Income Protection

Income Protection pays you a monthly amount if you are unable to work due to illness or injury - so you can carry on with your life even though you're not earning.

Disability Cover

Critical Conditions Cover

Are you thinking... where to from here?

If you're not sure about the type of cover you should get, how much cover you need, or how your cover will fit into your budget, then this is the place for you. Check out our tools for insurance advice, see what cover others like you have, or play around with our quick quote to align your cover with your budget.

Easy Online Life Insurance

Helping New Zealander's get their Life Cover sorted for the past 20 years (and many more to come)

-

1

Get a quote

Select your products and add a few details to get started (you can edit products later). Adjust your lump sum payout amount and monthly premiums to find the right balance for you.

-

2

Apply online

We’ll ask you some health and lifestyle questions; depending on your answers, you could be covered in just 10 minutes.

-

3

Get covered

We’ll email you your policy. Your cover starts immediately, provided we receive your first payment within 14 days.

Why Pinnacle Life?

We want Kiwis to be able to protect those that matter most, in a way that is easy and affordable.

-

Online cover made simple

We write everything in plain English so that it's easy to understand with no surprises. Life cover should be simple.

-

Designed for Kiwis

We want every family in Aotearoa to have the choice of getting the protection of life insurance and we want it to be easy

-

Affordable insurance

We know life can get expensive, so we tailor our advice to something you can afford.

Our customers say the loveliest things

View all reviewsI needed to transfer ownership of my life policy to myself as my wife has passed. I had last year claimed her life policy where the process was straight forward and I received the payout was prompt.

Provided just what we needed and very professional.

Clear product knowledge, no hard selling, seamless process.

Easy to understand, listen to what l required, very easy fast process over the phone. Very happy with the service l received.

Very easy, first time ever Life insurance was easy. Other providers had equal opportunity but couldn't provide a confirmed quote a month after I applied.

It gave me the same cover, as my previous provider, but much cheaper. Great value for money.

Easy online application. Price for cover is affordable.

Easy friendly service. Good pricing I think

Amazing online platform and awesome follow up from the pinnacle team. Should be an example to all other insurance companies

Great service,

Easy access,

Friendliness.