Life Insurance

Pinnacle Life Insurance. Easy and Affordable.

Life insurance provides for those you leave behind. It helps them pay the mortgage, invest in education, put food on the table, and pay the bills.

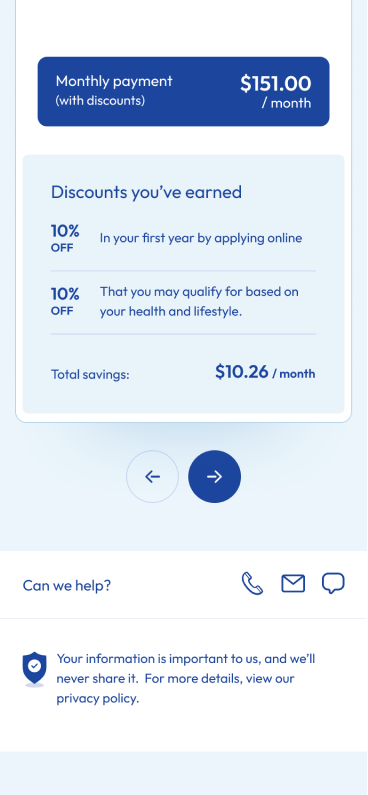

Pinnacle Life Insurance costs from $15.60 per month including a 10% discount for the first year, and 10% healthy lifestyle discount that you may or may not be eligible for.

We understand the stakes couldn't be higher.

Life Insurance can be a challenging topic, especially when it involves the people you care about most. With life being so busy, it's important to get it sorted once, and get it done right. We're here to guide you through the process, ensuring you have peace of mind knowing your loved ones will receive the financial support they need if the worst were to happen.

Life Insurance basics

Policy summary

Our Pinnacle Life policy provides you with an agreed tax-free lump sum if you die or are diagnosed with a terminal illness and have less than 12 months to live. This provides peace of mind that your loved ones will be financially protected.

Flexible cover where you have the freedom to choose and adjust the level of cover that best suits your needs and budget, giving you control over your financial security.

Change your mind within 30 days of starting your Pinnacle Life policy? We’ll refund your money, no questions asked.

What's covered?

Our comprehensive life policy covers all the common and less common causes of death for New Zealanders, including accidents and illnesses such as cancer, heart attack, stroke, respiratory diseases, kidney failure, diabetes, and other diseases.

Comprehensive additional benefits, including advanced funeral cover, children's funeral payment, and more. Additional benefits are explained below.

What's not covered?

Suicide within the first 13 months of policy issue. Suicide is covered from month 14 onwards.

Depending on your health and lifestyle other exclusions may be added to your policy.

*More details are in the application process and your policy document.

Your privacy

Your information is important to us. We will never share your information.

For more details, view our Privacy Policy.

When does your cover end?

As long as you continue making payments, your Life Cover ends on the day we pay out the full amount of the Life Cover.

You may also choose to cancel your policy at any time.

- There is no savings or investments with this policy, and it doesn’t expire. If your payments are up to date, your cover will continue until you die, and we pay your claim.

When you need to claim

- If you die, we will pay the policy owner unless you have nominated a beneficiary, in which case they will receive the payment.

- The payment is tax-free if the policy owner is a person (rather than a trust or company).

- We will pay the claim in New Zealand dollars anywhere in the world.

- If you’re diagnosed with a terminal illness and expect to live less than 6-12 months (depending on your policy), you can have your lump sum amount paid early.

Pinnacle Life's added protection

In addition to your comprehensive Life Insurance cover, your Pinnacle Life policy also comes with these additional benefits*:

- Financial Planning Support - After paying a life cover claim, we’ll reimburse up to $3000 for financial planning or legal advice.

- Counselling Cover - We’ll reimburse up to $2500 for consultations with a counsellor, psychiatrist, or psychologist.

- Advance Funeral Payment - We’ll pay $15,000 to help with funeral or tangi costs to help loved ones cover immediate costs.

- Child Funeral Payment - Losing a child is devastating. We’ll pay $10,000 to the life insured if an insured person’s biological or legally adopted child aged 18 years or under dies.

- Financial Hardship Option - If you are experiencing financial hardship, you can apply to suspend your cover for up to 12 months. Please refer to your policy document, or our sample policy for more details.

*These benefits are only available on policies issued after November 2024.

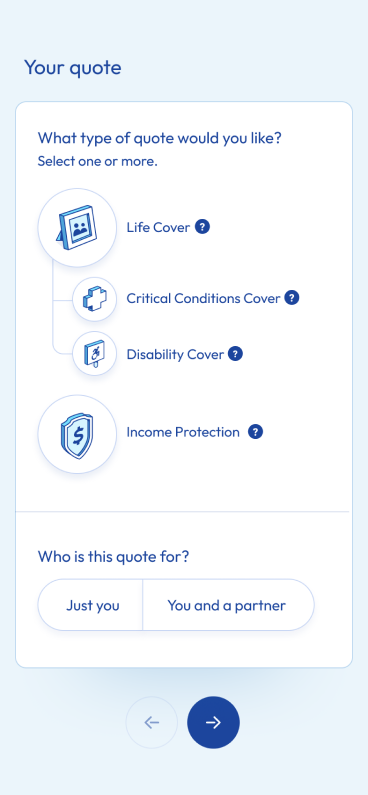

Add on additional cover to your Life Insurance

Income Protection

Income Protection pays you a monthly amount if you are unable to work due to illness or injury - so you can carry on with your life even though you're not earning.

Disability Cover

Having Total and Permanent Disability cover means that if you become permanently unable to work, or meet our Total and Permanent Disability definitions due to accident or illness, you will receive a lump sum payment to use however you need.

Critical Conditions Cover

Having Critical Conditions Cover means that if you suffer from one of the 38 conditions specified in your policy, you will receive a lump sum payment to use however you need.

How it works

If you change your mind within 30 days, we guarantee a full refund - no questions asked.

-

1

Get a quote

Select your products and add a few details to get started (you can edit products later). Adjust your lump sum payout amount and monthly premiums to find the right balance for you.

-

2

Apply online

We’ll ask you some health and lifestyle questions; depending on your answers, you could be covered in just 10 minutes.

-

3

Get covered

We’ll email you your policy. Your cover starts immediately, provided we receive your first payment within 14 days.

Need help working out how much life insurance cover is right?

What type of cover should you choose? How much cover should you get? How much will it cost? For many people, this is where buying life insurance gets complicated and overwhelming. We've got the tools to help.

Our customers say the loveliest things

View all reviewsI started a online application, and saved it because I became busy, a couple of hours later had a phone call from a lovely man, who helped me finish the application,, nothing was any trouble, including holding off paying for a couple of weeks because I had just paid life insurance with another provider who I had been with for years, but became too expensive. Highly recommend.

Provided just what we needed and very professional.

Clear product knowledge, no hard selling, seamless process.

Very fast service and considerate in all aspects.

Very clear and understandable communication, and pricing plans very decent.

Frequently asked questions

What are your age limits?

What are your age limits?

We offer cover to people aged between 18 and 75. Specifically, the age limits are:

For Life Insurance

- you can apply online if you are aged 20-69

- or by talking to us if you are 18-74.

- You can be living in NZ, Australia, USA, Canada, UK, Ireland, Hong Kong or Singapore.

For Income Protection

- you can apply if you are 20-59 and,

- living and working in NZ.

For Critical Conditions (note you can only apply for Critical Conditions at the same time that you apply for life insurance)

- You can apply online if you are age 20-59

For Disability Cover (note you can only apply for Disability Cover at the same time that you apply for life insurance)

- You can apply online if you are age 20-59

What types of life insurance cover does Pinnacle offer?

What types of life insurance cover does Pinnacle offer?

We offer a comprehensive Life Insurance policy where you set the tax-free payout amount. You can add your partner for a joint policy and enhance your cover with options like Critical Conditions, Disability, or Income Protection.

How do I apply for life insurance with Pinnacle?

How do I apply for life insurance with Pinnacle?

Apply online for life insurance in just 10 minutes. Get a quote in 30 seconds by providing your gender, age, and smoking status. Adjust the tax-free payout amount to fit your needs, and if you’re happy with the monthly premium, answer a few health questions and set up your payment. Need help? Our team is here to support you every step of the way. Call 0800 22 22 23 or contact us anytime.

Do I need a medical exam to get cover?

Do I need a medical exam to get cover?

Most of our customers don't need a medical exam. However, occasionally, we may need more information from your doctor to assess your application, and sometimes, we may ask for a medical exam or a blood test. If this is the case, we will discuss it with you first.

Can I get help understanding my cover options?

Can I get help understanding my cover options?

Yes! Our team is here to answer any questions you may have. Call 0800 22 22 23, email us at getcovered@pinnaclelife.co.nz or use our contact us form. Alternatively, check out our award-winning free advice tool to help work out what cover is right for you.

What happens if I need to make a claim?

What happens if I need to make a claim?

You can learn more about claims here. Alternatively, simply give us a call at 0800 22 22 23 or email ask@pinnaclelife.co.nz. We’ll walk you through the process and let you know what information we need. We aim to pay most claims within 7-10 days of receiving all the required documentation.

Will Pinnacle Life pay out?

Will Pinnacle Life pay out?

Pinnacle Life has paid 93.6%* of the claims made on our policies. That’s because everything we do, from the moment you first take out a policy, is about making sure we can pay your claim when the time comes. As long as you provide accurate information in your application, pay your premiums on time, and keep us updated on any health or lifestyle changes, you can rest assured that we will pay out as promised.

*as at 30th April 2025.

Choose Pinnacle Life for proven, award-winning life insurance that has been safeguarding Kiwis for over two decades.

Experience the peace of mind that comes with affordable, simple and secure life insurance cover.