As we come to the end of 2022, many of us are looking forward to a covid-free (and lockdown-free) Christmas. With cases currently on the rise, we hope this is you! 2022 has seen a much-anticipated slowdown in an almost three-year global pandemic. However, on the downside, we are now experiencing an economic downturn bringing rising costs, making things challenging for many of us.

Stats NZ recorded a 7.2% annual inflation rate in the September 2022 quarter. Rising costs have been ongoing since the early days of Covid-19, driven mainly by global supply chain issues. These supply constraints, along with the soar in energy prices due to the war in Ukraine, have affected food prices in New Zealand, as well as costs of construction, rent, and local authority rates.

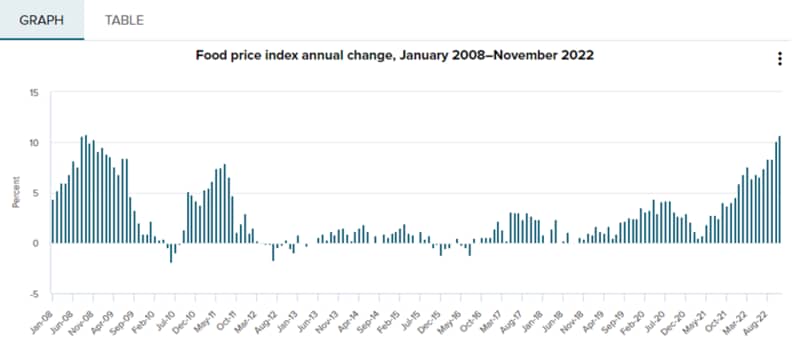

According to Stats NZ, New Zealand saw an increase in food prices by 10.7% year on year when comparing November 2022 with 2021. October saw a similar rise with an increase of 10.1%. November was the highest annual increase since November 2008. The Christmas dinner better be delicious this year as it’s going to cost more than usual!

But what does all this have to do with life insurance?

Over time it’s easy to forget why we took out life insurance in the first place, especially when we’re looking at our budgets to find places to cut back. Premiums go up yearly as you age, with no additional benefits, even without factoring in inflation, so will be more expensive than when you first took it out. Keeping your cover in line with inflation, however, is essential if you want the value of your policy to be the same as when you took it out (that is, for it to pay for the things you need).

There are some great reasons why Pinnacle Life insurance is perhaps even more critical when inflation is high:

1.You can change your cover as your life (or budget) changes –Things change. As your needs change, you can apply to increase or decrease your life cover. You might need more cover if you’ve increased your mortgage or had kids, or you might want less if your budget is under strain, you’ve downsized, or your kids are now independent.

2.Nobody lives forever - If we want our loved ones to be taken care of if we die earlier than we hope, then Life Insurance can do that for us. Leaving your family with money to set themselves up for the future, or even to just cover the funeral, means they will have less to worry about in a time of financial stress.

3.The chances of becoming seriously ill are high, and it’s expensive – In NZ, 63 people are diagnosed with cancer every day, and 24 people have a stroke, 1 in 21 adults are living with heart disease. Pinnacle Life insurance includes a Terminal Illness benefit. That means if you’re diagnosed with a terminal illness and expect to live less than 6 -12 months (depending on your policy), you can claim on your policy early. We also offer critical illness cover, which means if you suffer one of the 24 conditions specified in your policy, you will receive a lump sum payment to use however you need. Living with illness can be seriously expensive and reduces your ability to earn an income. When things are already costly, having enough money to support yourself and your family in a time of great need can be a great relief.

4.Pinnacle offers excellent value – We frequently compare our prices and benefits to other providers to ensure you have the best value life insurance in NZ. Our research shows our premiums are generally cheaper than car insurance! So even given the current economic climate, you can be sure to find the best value with us.

Paying for life cover means less money to pay for something else. We get that. Only you can choose for you and your family when it comes to your financial situation and your financial future. But the benefits of having life cover are high. Get started by getting a quote; it takes less than 30 seconds with Pinnacle Life.